Author Archives: admin

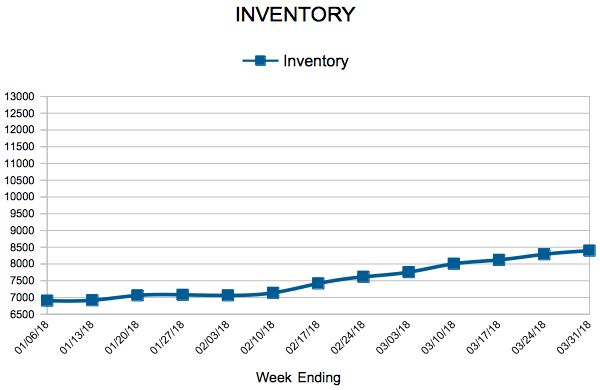

Inventory

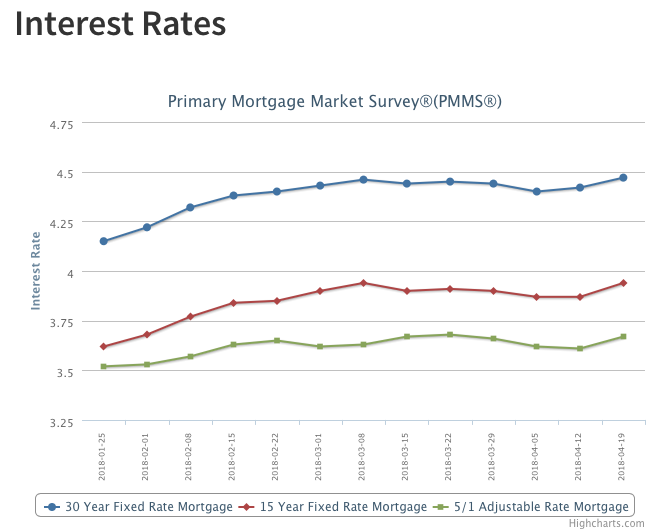

Rates Rise to Highest of 2018

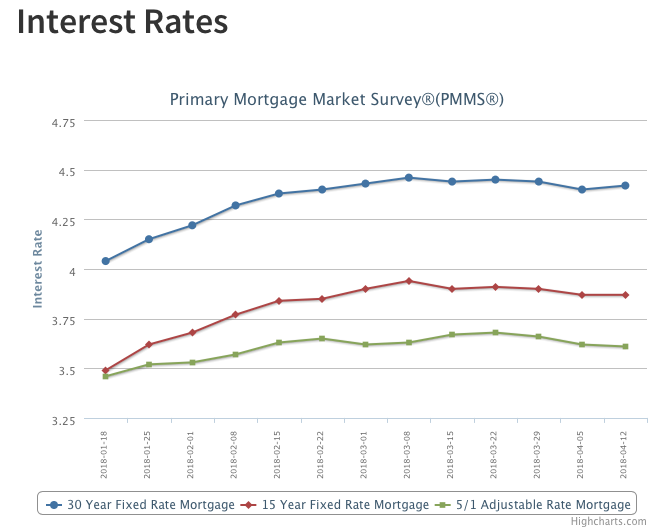

Treasury yields rose ahead of the release of the Fed’s Beige Book and speeches from New York Fed President William Dudley and Fed Governor Randal Quarles. Following Treasurys, mortgage rates soared. The U.S. weekly average 30-year fixed mortgage rate rose 5 basis points to 4.47 percent in this week’s survey, its highest level since January of 2014 and the largest weekly increase since February of this year.

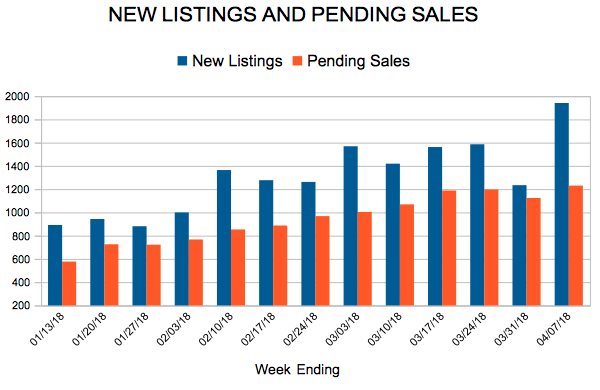

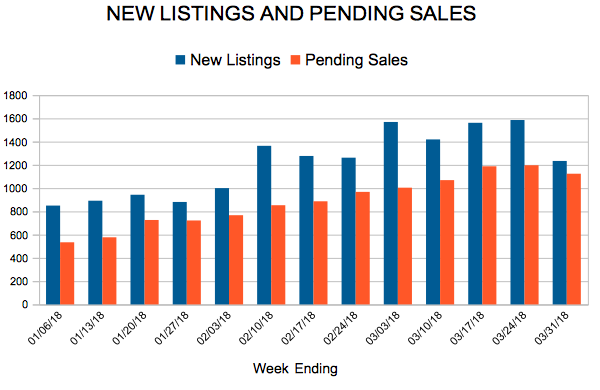

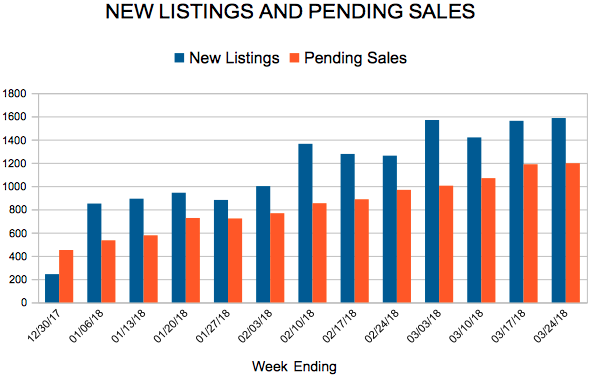

New Listings and Pending Sales

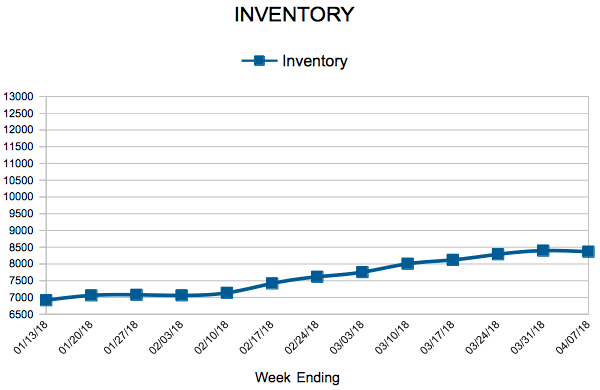

Inventory

Mortgage Rates Holding Steady

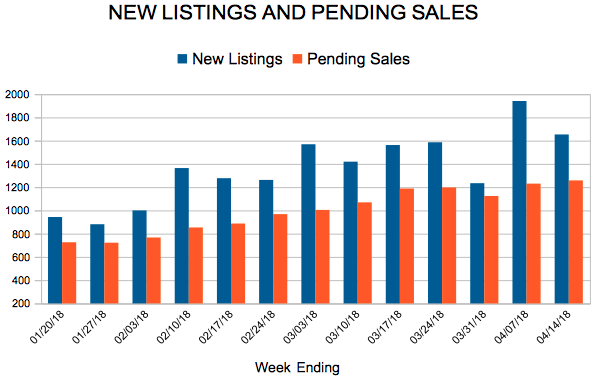

New Listings and Pending Sales

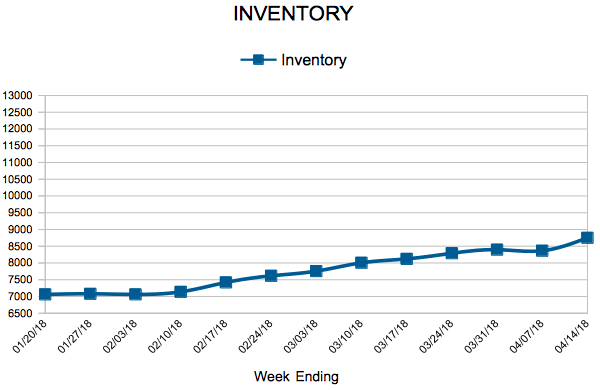

Inventory

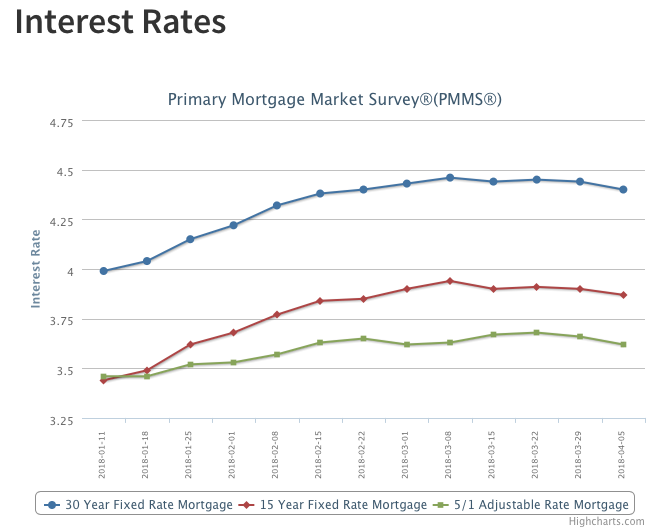

Mortgage Rates Down Again

After dropping earlier this week on trade-related anxiety in financial markets, the benchmark 10-year Treasury stabilized on Wednesday, but at a level slightly lower than from the start of last week. Mortgage rates followed and fell for the second consecutive week; the U.S. weekly average 30-year fixed mortgage was 4.4 percent in the Primary Mortgage Market Survey® (PMMS®) this week. Though rates on the 30-year fixed mortgage are up 0.3 percentage points from the same week a year ago, a robust labor marking is helping home purchase demand weather modestly higher rates.