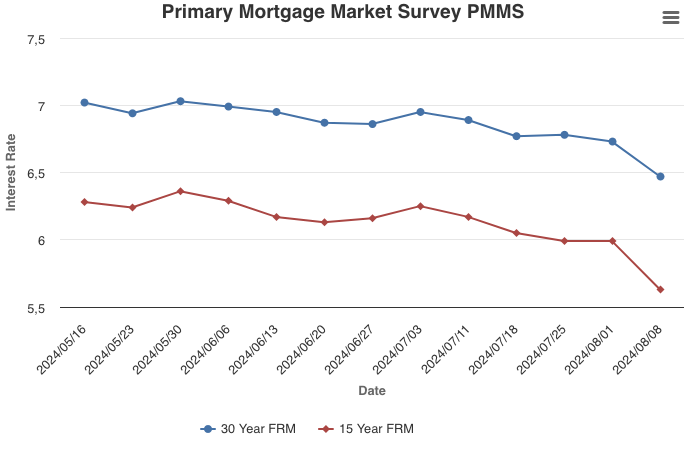

August 8, 2024

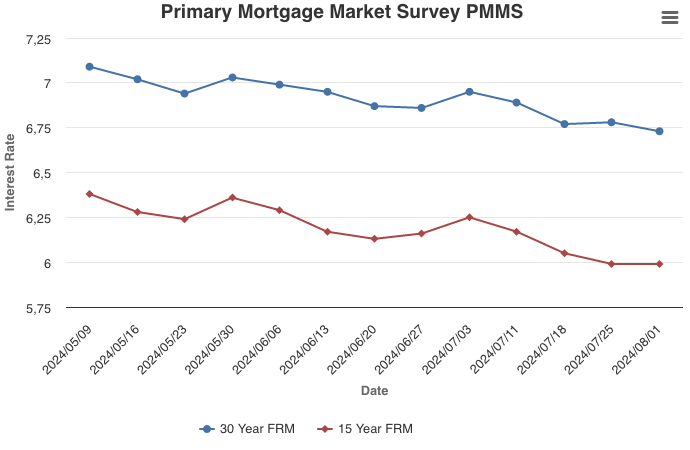

Mortgage rates plunged this week to their lowest level in over a year following the likely overreaction to a less than favorable employment report and financial market turbulence for an economy that remains on solid footing. The decline in mortgage rates does increase prospective homebuyers’ purchasing power and should begin to pique their interest in making a move. Additionally, this drop in rates is already providing some existing homeowners the opportunity to refinance, with the refinance share of market mortgage applications reaching nearly 42 percent, the highest since March 2022.

Information provided by Freddie Mac.