Monthly Archives: July 2024

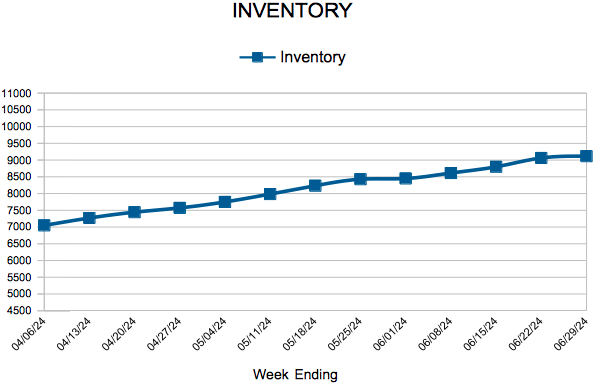

Inventory

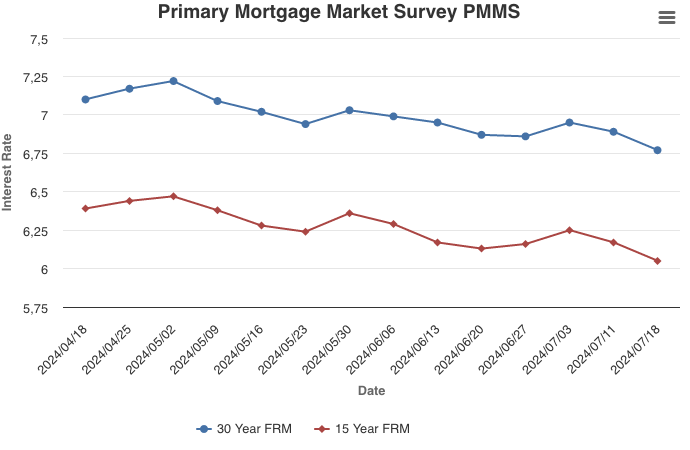

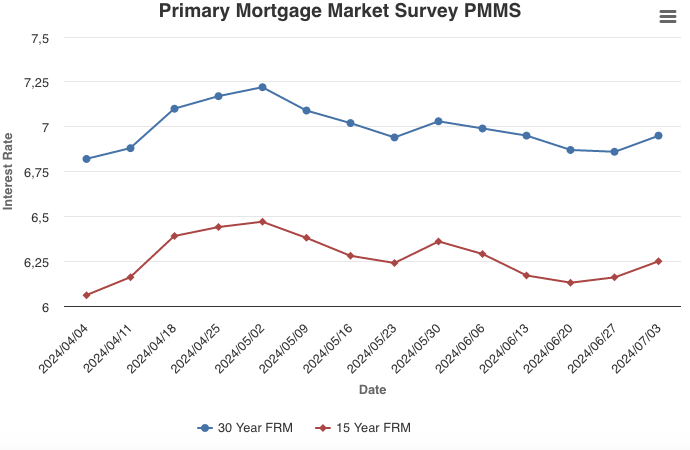

Mortgage Rates Continue to Fall

July 18, 2024

The 30-year fixed-rate mortgage fell to its lowest level since mid-March, dropping 12 basis points from last week. Mortgage rates are headed in the right direction and the economy remains resilient, two positive incremental signs for the housing market. However, homebuyers have yet to respond to lower rates, as purchase application demand is still roughly 5 percent below Spring, when rates were approximately the same. This is not uncommon: sometimes as rates decline, demand weakens, and the apparent paradox is driven by buyers making sure rates don’t decline further before they decide to purchase.

Information provided by Freddie Mac.

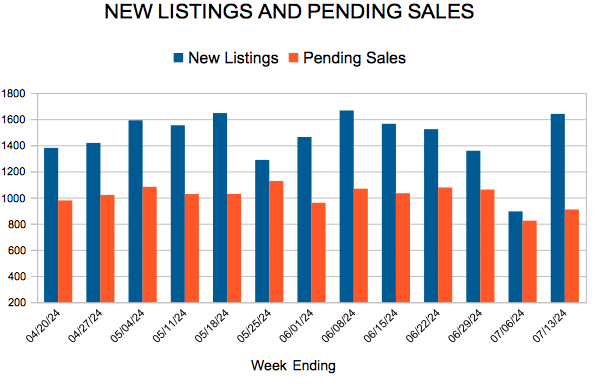

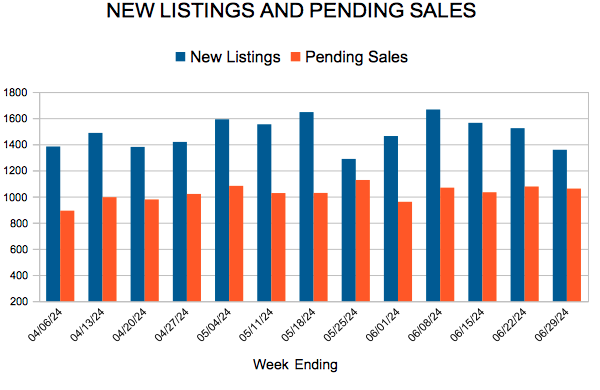

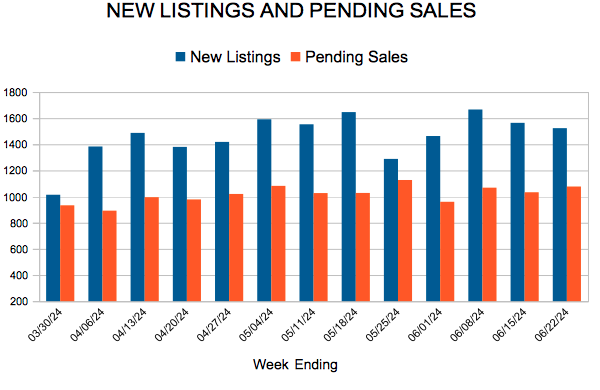

New Listings and Pending Sales

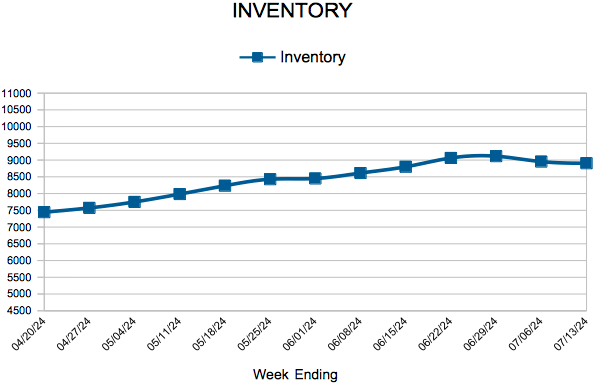

Inventory

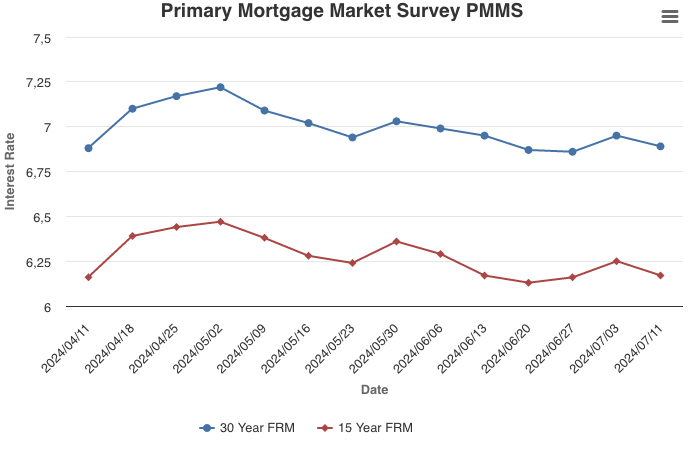

Mortgage Rates Tick Down as Markets Digest Incoming Data

July 11, 2024

Following June’s jobs report, which showed a cooling labor market, the 10-year Treasury yield decreased this week and mortgage rates followed suit. There is also more inventory on the market, including a fair number of listings with price cuts, which is an encouraging sign for prospective buyers.

Information provided by Freddie Mac.

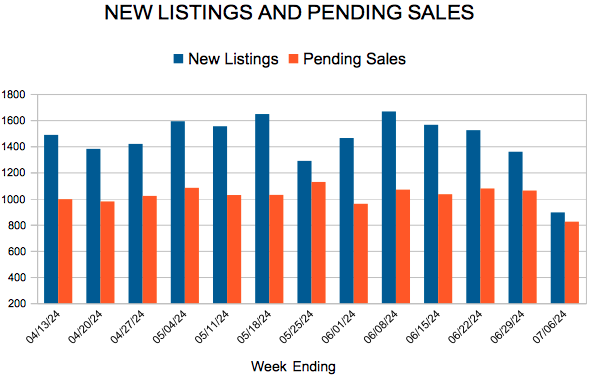

New Listings and Pending Sales

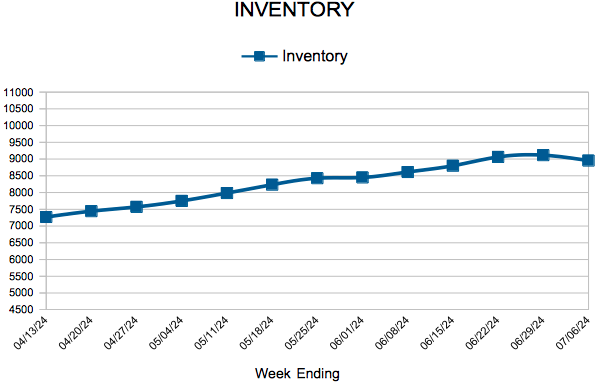

Inventory

Mortgage Rates Increase

July 3, 2024

Mortgage rates increased this week, coming in just under seven percent. Both new home and pending home sales are down, causing active listings to rise. We are still expecting rates to moderately decrease in the second half of the year and given additional inventory, price growth should temper, boding well for interested homebuyers.

Information provided by Freddie Mac.