May 9, 2024

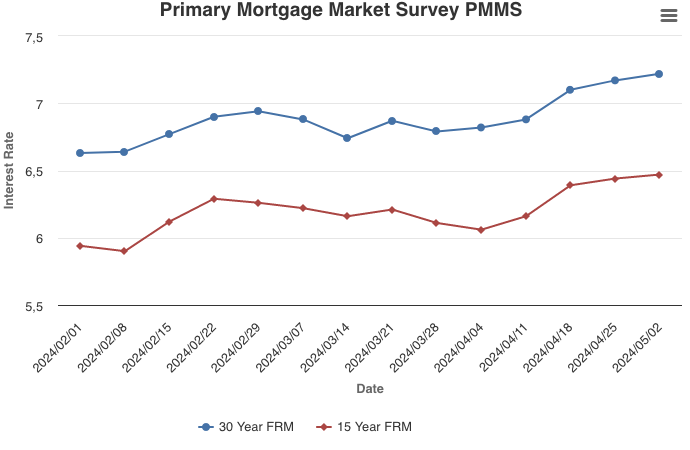

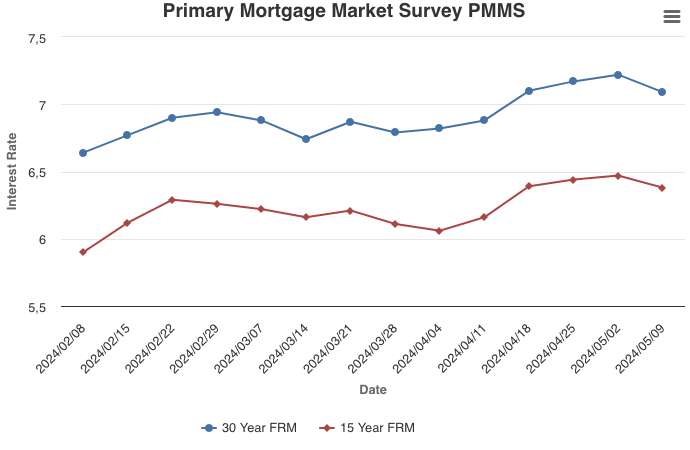

After a five week climb, mortgage rates ticked down following a weaker than expected jobs report. An environment where rates continue to hover above seven percent impacts both sellers and buyers. Many potential sellers remain hesitant to list their home and part with lower mortgage rates from years prior, adversely impacting supply and keeping house prices elevated. These elevated house prices add to the overall affordability challenges that potential buyers face in this high-rate environment.

Information provided by Freddie Mac.