Monthly Archives: April 2024

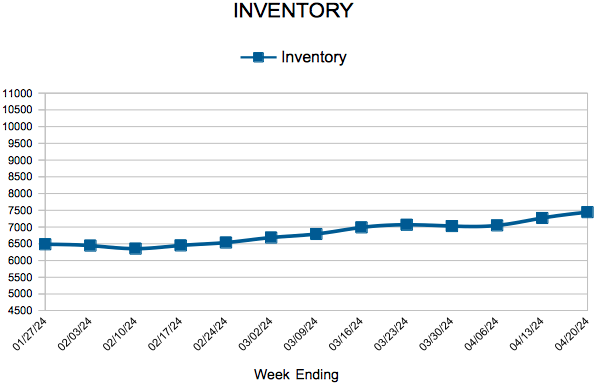

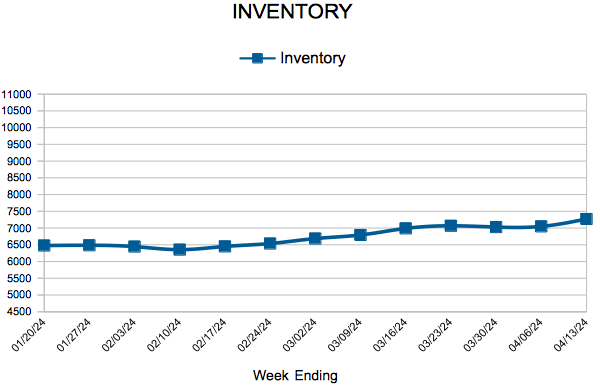

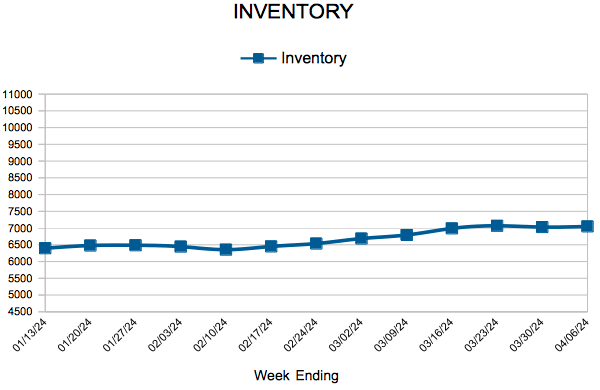

Inventory

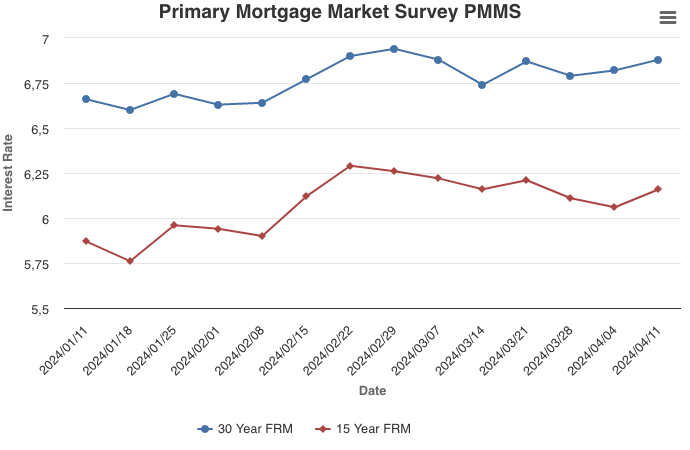

Mortgage Rates Continue to Increase

April 25, 2024

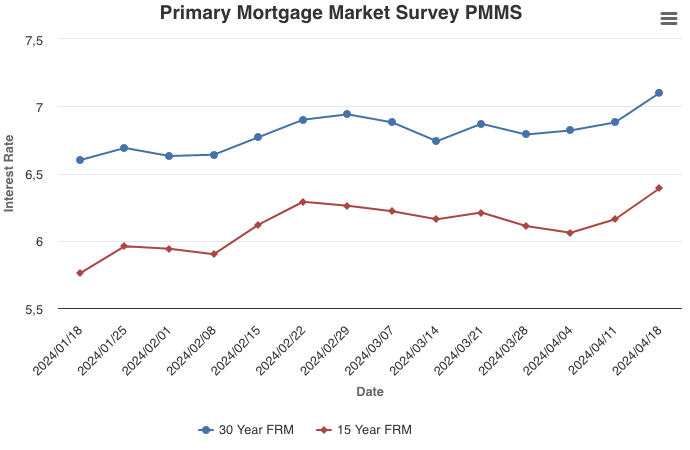

Mortgage rates continued rising this week. Despite rates increasing more than half a percent since the first week of the year, purchase demand remains steady. With rates staying higher for longer, many homebuyers are adjusting, as evidenced by this week’s report that sales of newly built homes saw the biggest increase since December 2022.

Information provided by Freddie Mac.

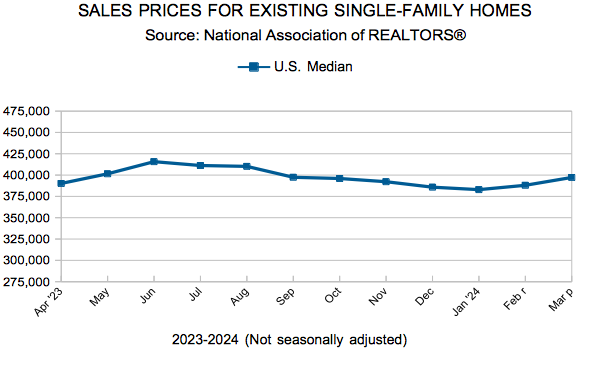

Existing Home Sales

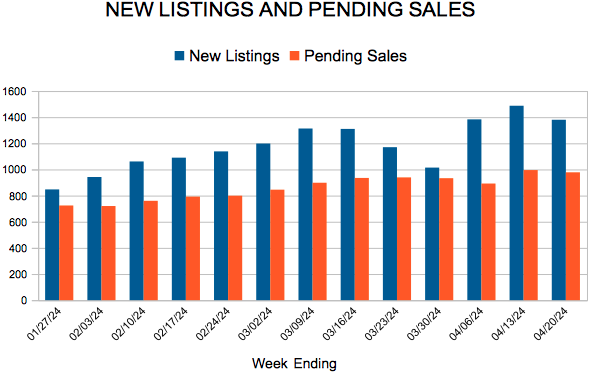

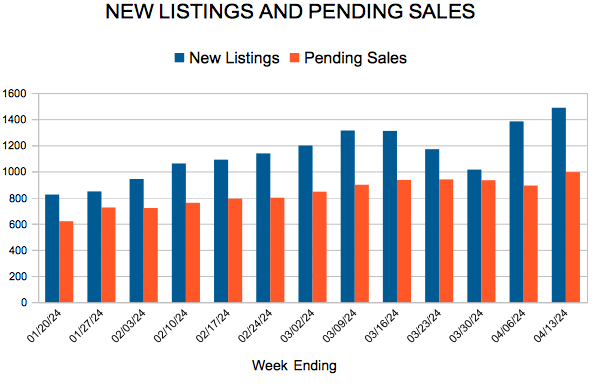

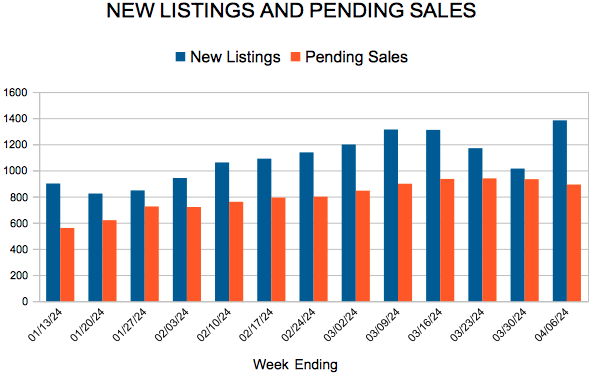

New Listings and Pending Sales

Inventory

Mortgage Rates Exceed 7 Percent for the First Time this Year

April 18, 2024

The 30-year fixed-rate mortgage surpassed 7 percent for the first time this year, jumping from 6.88 percent to 7.10 percent this week. As rates trend higher, potential homebuyers are deciding whether to buy before rates rise even more or hold off in hopes of decreases later in the year. Last week, purchase applications rose modestly, but it remains unclear how many homebuyers can withstand increasing rates in the future.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Mortgage Rates Move Toward Seven Percent as Markets Digest Incoming Data

April 11, 2024

Mortgage rates have been drifting higher for most of the year due to sustained inflation and the reevaluation of the Federal Reserve’s monetary policy path. While newly released inflation data from March continues to show a trend of very little movement, the financial market’s reaction paints a far different economic picture. Since inflation decelerated from 9% to 3% between June 2022 and June 2023, the annual growth rate of inflation has remained effectively flat, ranging from 3.1% to 3.7% and averaging 3.3%. The March estimate of 3.5% annual growth is in the middle of that range. However, the market’s reaction was dramatically different, as illustrated by a significant drop in the Dow Jones Industrial Average post-announcement.

It’s clear that while the trend in inflation data has been close to flat for nearly a year, the narrative is much less clear and resembles the unrealized expectations of a recession from a year ago.

Information provided by Freddie Mac.