Monthly Archives: September 2019

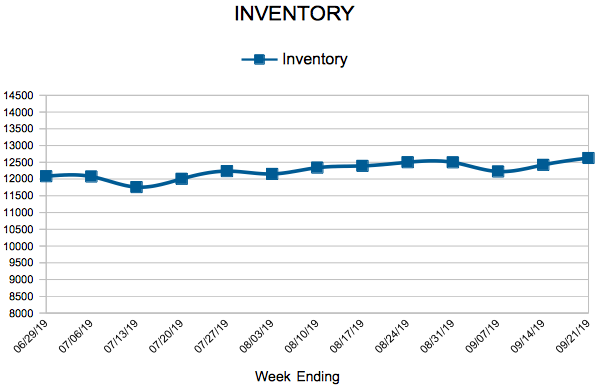

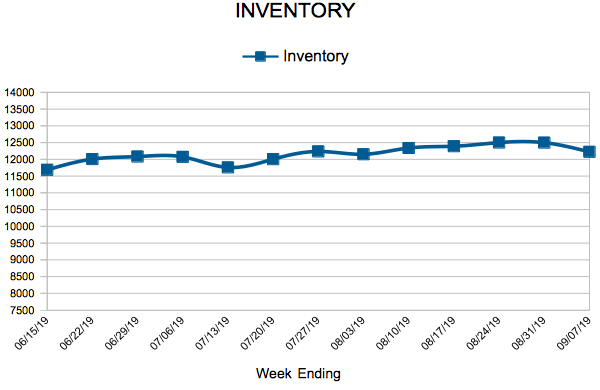

Inventory

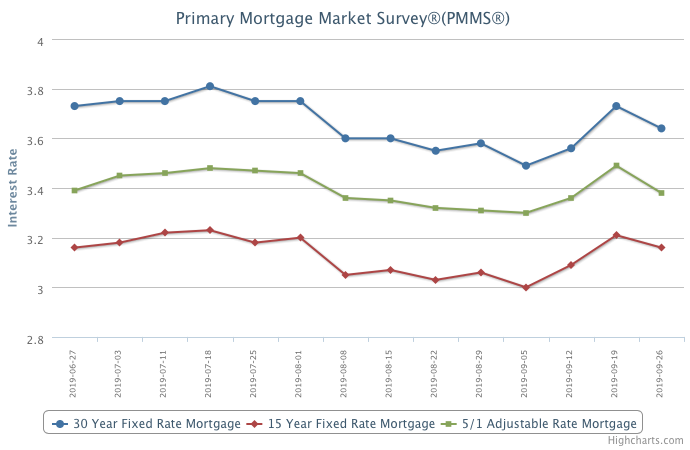

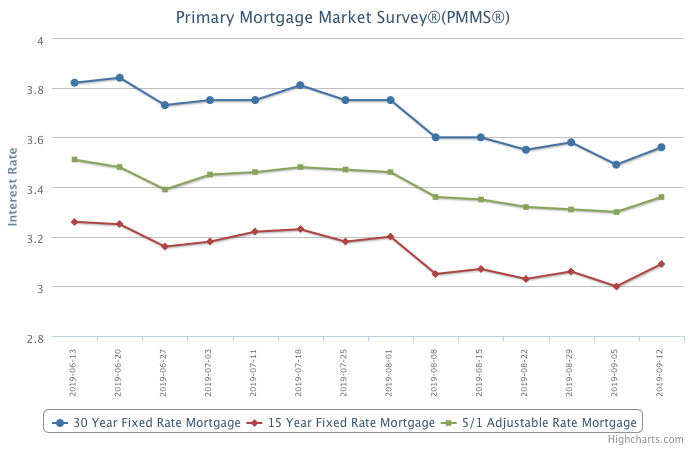

Mortgage Rates Decrease

September 26, 2019

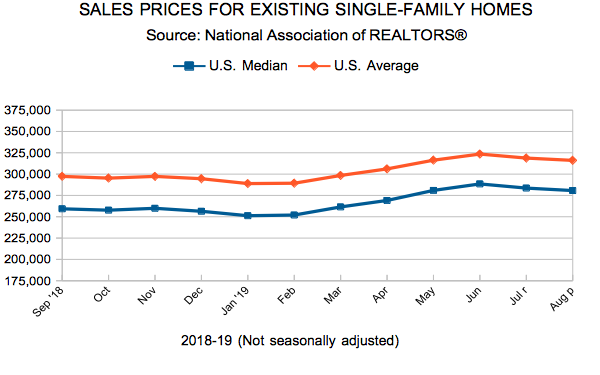

With both the unemployment rate and mortgage rate below four percent and near historic lows, it is no surprise that the housing market regained momentum with home sales and construction at or near decade highs. The fall housing market is poised to continue with steady gains in prices and solid sales activity.

Information provided by Freddie Mac.

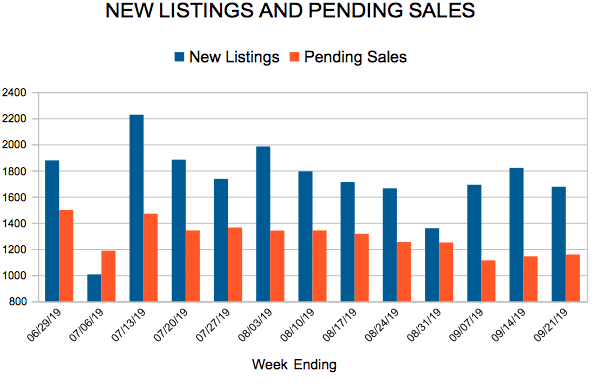

New Listings and Pending Sales

Inventory

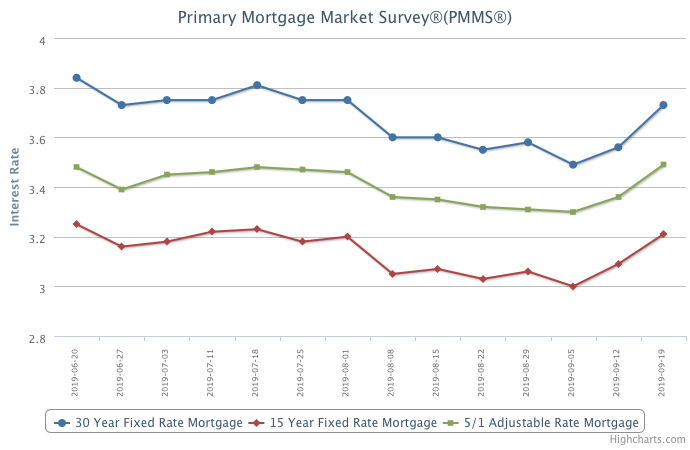

Mortgage Rates Jump

September 19, 2019

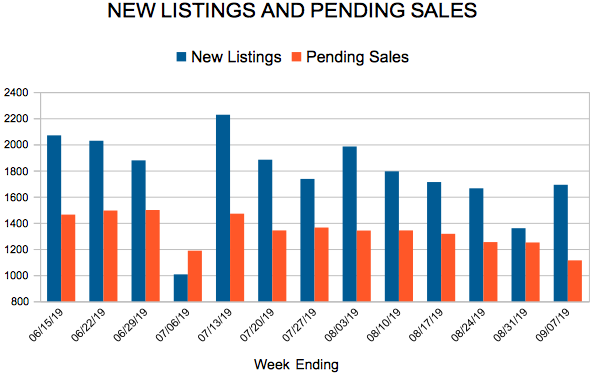

Despite the rise in mortgage rates, economic data improved this week – particularly housing activity, which gained momentum with a noticeable rise in purchase demand and new construction. Homebuyers flocked to lenders with purchase applications, which were up fifteen percent from a year ago and residential construction permits increased twelve percent from a year ago to 1.4 million, the highest level in twelve years. While there was initially a slow response to the overall lower mortgage rate environment this year, it is clear that the housing market is finally improving due to the strong labor market and low mortgage rates.

Information provided by Freddie Mac.

Existing Home Sales

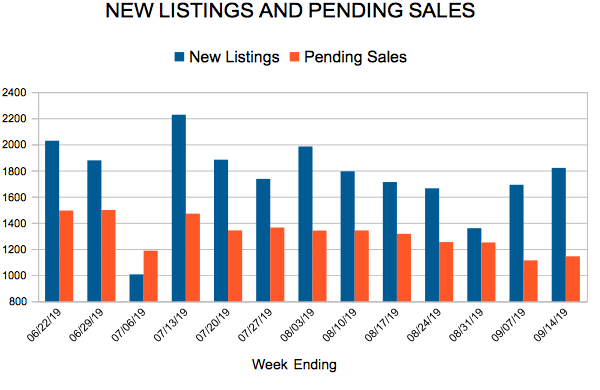

New Listings and Pending Sales

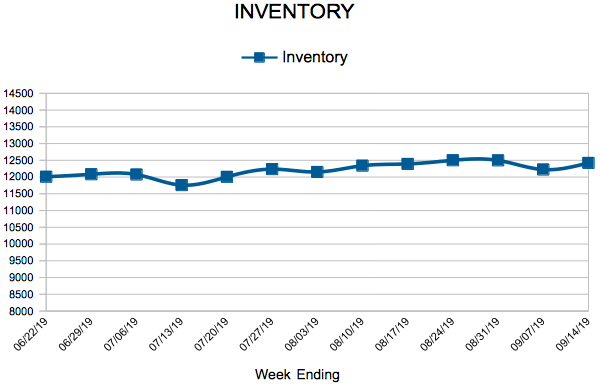

Inventory

Mortgage Rates Increase

September 12, 2019

Pipeline purchase demand continues to improve heading into the late fall with purchase mortgage applications up nine percent from a year ago. The improved demand reflects the still healthy underlying consumer economic fundamentals such as a low unemployment rate, solid wage growth and low mortgage rates. While there has been a material weakness in manufacturing and consistent trade uncertainty, so far, the American consumer has proved to be resilient with solid home purchase demand.

Information provided by Freddie Mac.