Monthly Archives: February 2018

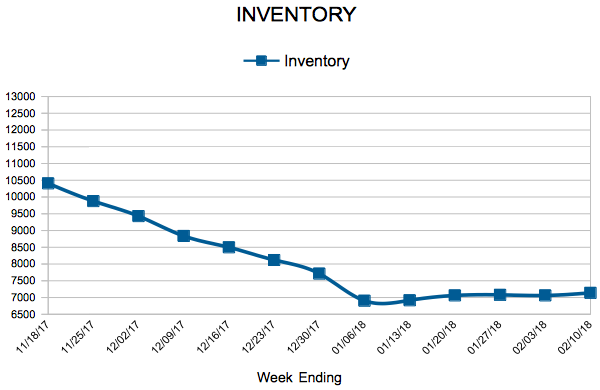

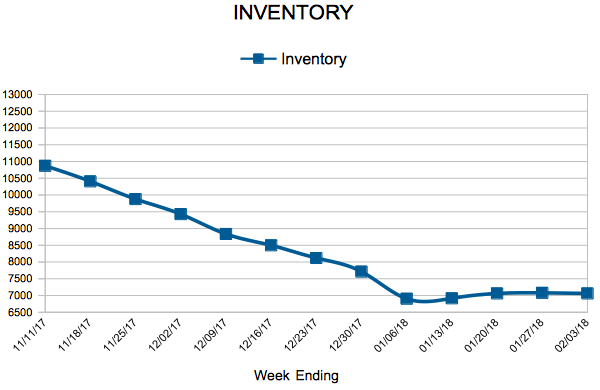

Inventory

Mortgage Rates Continue Upward Climb

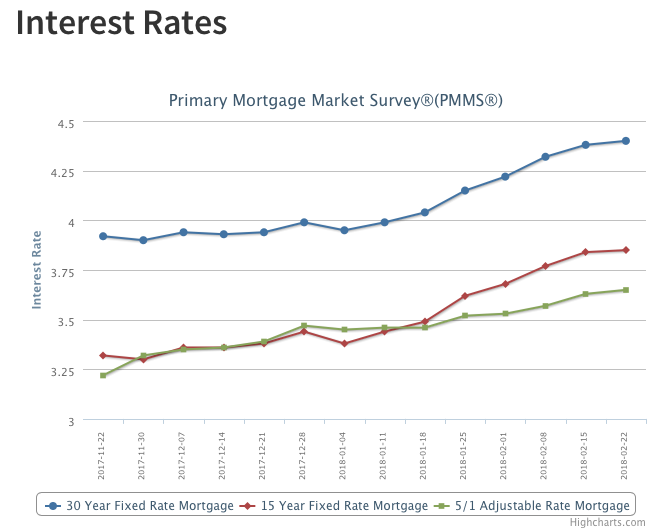

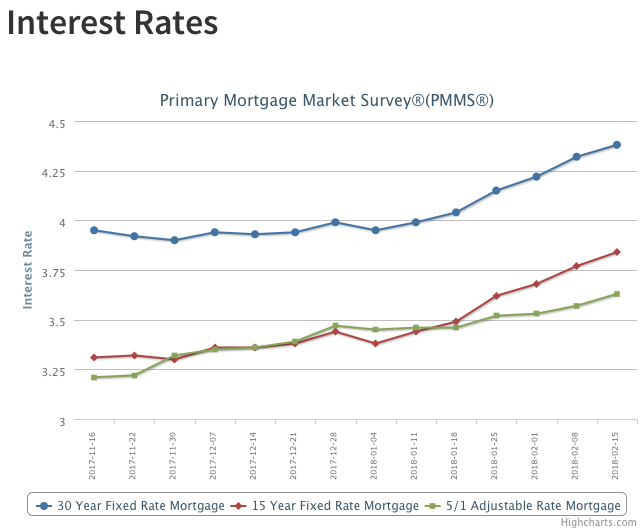

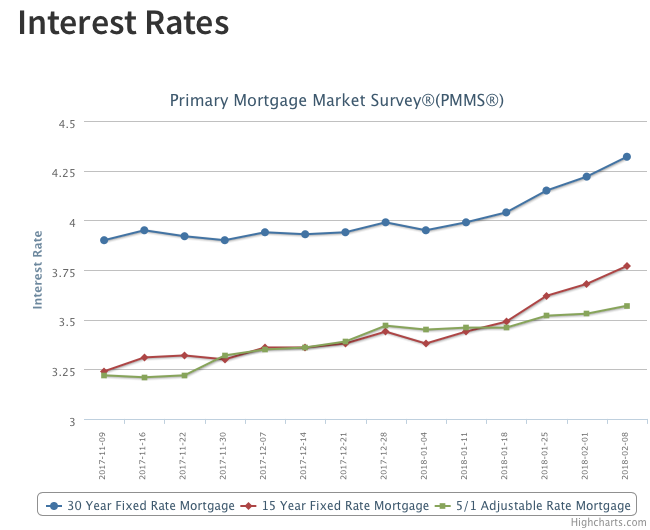

Fixed mortgage rates increased for the seventh consecutive week, with the 30-year fixed mortgage rate reaching 4.40 percent in this week’s survey; the highest since April of 2014. Mortgage rates have followed U.S. Treasurys higher in anticipation of higher rates of inflation and further monetary tightening by the Federal Reserve. Following the close of our survey, the release of the FOMC minutes for February 21, 2018 sent the 10-year Treasury above 2.9 percent. If those increases stick, we will likely see mortgage rates continue to trend higher.

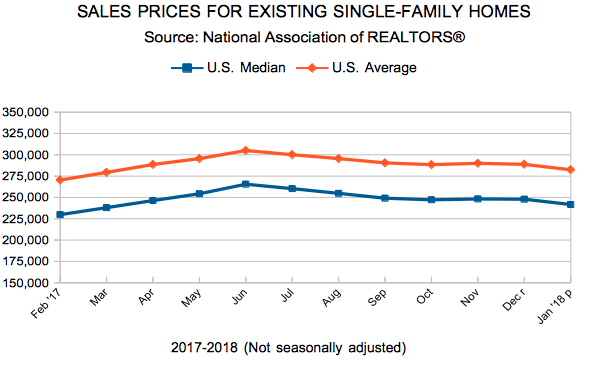

Existing Home Sales

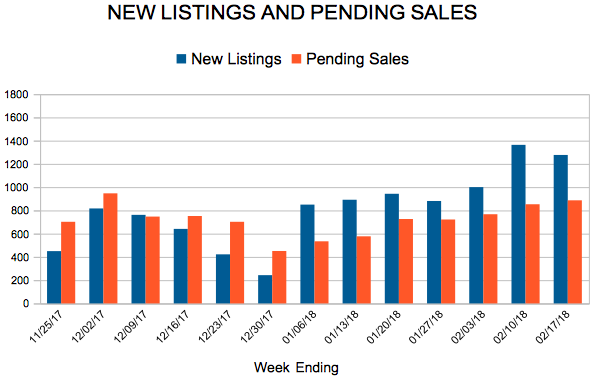

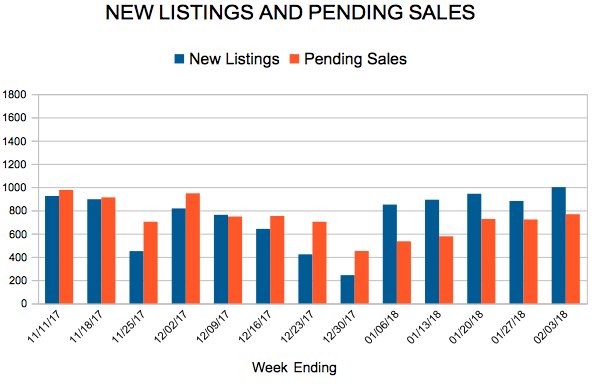

New Listings and Pending Sales

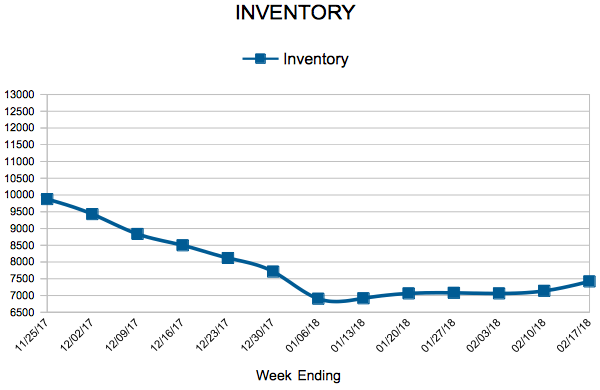

Inventory

Mortgage Rates Continue to Climb

Wednesday’s Consumer Price Index report showed higher-than-expected inflation; headline consumer price inflation was 2.1 percent year-over-year in January two tenths of a percentage point higher than the consensus forecast. Inflation measures were broad-based, cementing expectations that the Federal Reserve will go forward with monetary tightening later this year. Following this news, the 10-year Treasury reached its highest level since January 2014, climbing above 2.90 percent. Mortgage rates have also surged. After jumping 10 basis points last week, the 30-year fixed-rate mortgage rose 6 basis points to 4.38 percent, its highest level since April 2014.

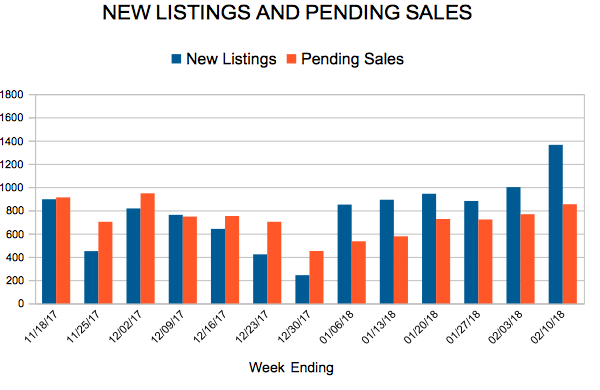

New Listings and Pending Sales

Inventory

Mortgage Rates Jump Again

The U.S. weekly average 30-year fixed mortgage rate rocketed up 10 basis points to 4.32 percent this week. Following a turbulent Monday, financial markets settled down with the 10-year Treasury yield resuming its upward march. Mortgage rates have followed. The 30-year fixed mortgage rate is up 33 basis points since the start of the year. Will higher rates break housing market momentum? It’s too early to tell for sure, but initial readings indicate housing markets are sustaining their momentum so far. The MBA reported that purchase applications are up 8 percent from a year ago in their latest Weekly Mortgage Applications Survey.