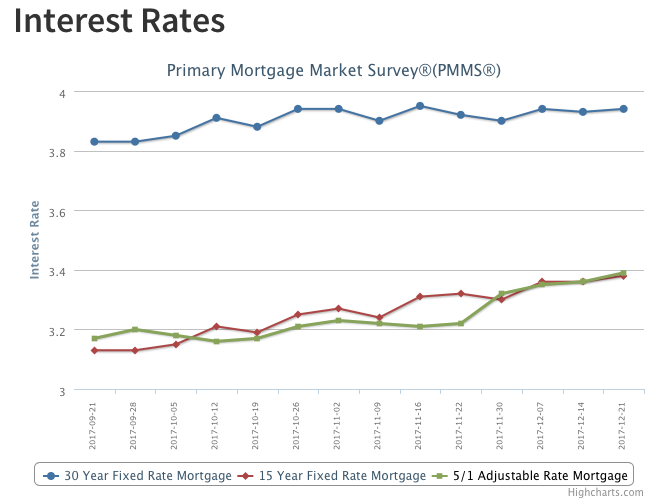

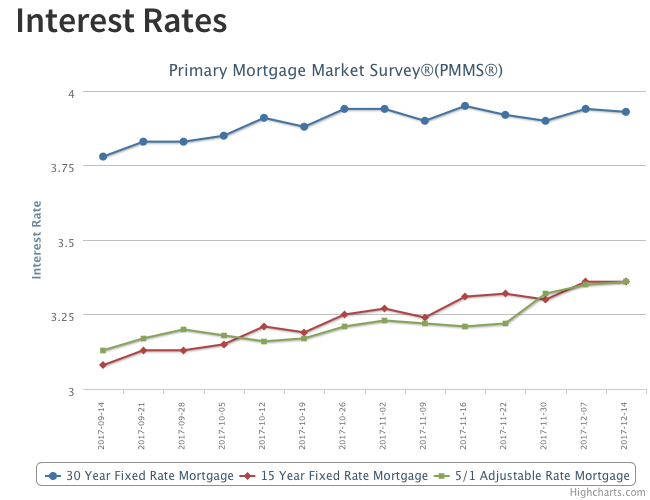

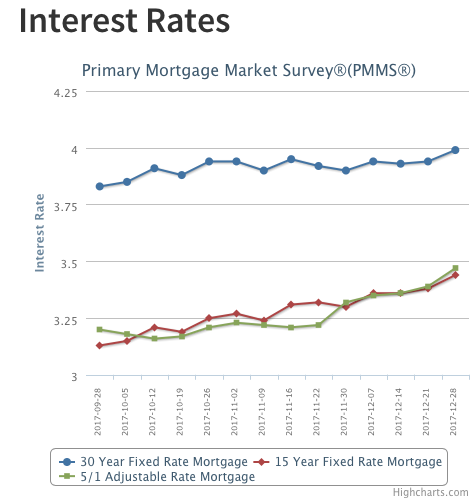

As expected, mortgage rates felt the effect of last week’s surge in long-term interest rates in the final, shortened week of 2017. The 30-year fixed mortgage rate increased 5 basis points to 3.99 percent in this week’s survey. Although this week’s survey rate represents a five-month high, 30-year fixed mortgage rates are still below the levels we saw at the end of last year and early part of 2017. Mortgage rates have remained relatively low all year.