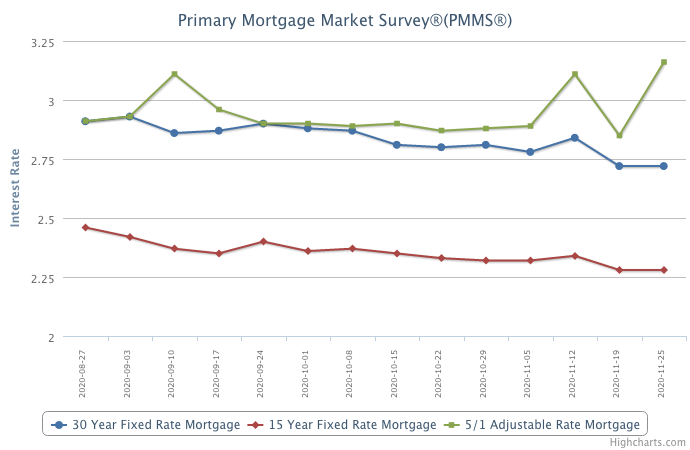

November 25, 2020

Mortgage rates remain at record lows and while that has fueled a refinance boom, it’s been driven mainly by higher income borrowers. With about 20 million borrowers eligible to refinance, lower-and middle-income borrowers are leaving money on the table by not taking advantage of low rates. On the homebuying side, demand continues to surge, and it has created a seller’s market where inventory is at a record low and home prices are rising, beginning to offset the benefits of the low rates.

Information provided by Freddie Mac.